On 7th June 2022, the RBA raised the official cash rate by 50 basis points to 0.85%. This is the second consecutive rate rise since 2010, with the prediction of more to come. Understandably, many home owners in Australia are concerned about the effects of rising interest rates and wondering whether they should fix their home loan. To answer this question, it is helpful to have a basic look at how money markets work and get some perspective on the current interest rate situation.

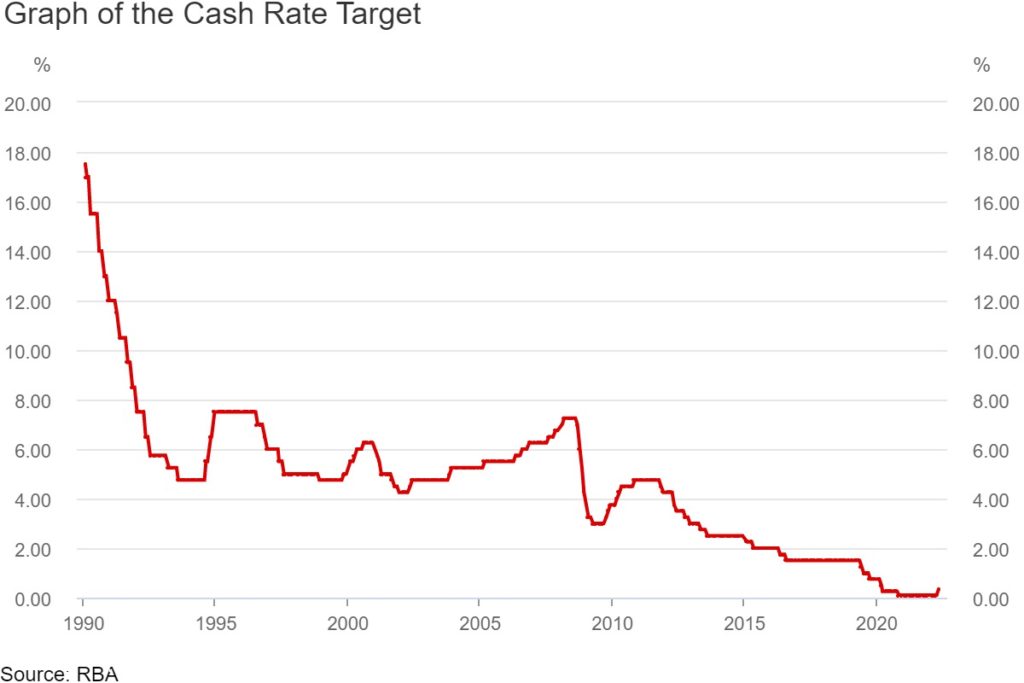

The cash rate is 0.85% today. The cash rate before the onset of COVID was 1.50% up until May 2019, and 0.75% in October 2019. The last increase to the official cash rate prior to COVID was on 3 November 2010 which was at 4.75%. Refer to the RBA official cash rate chart from 1990 until May 2022 below.

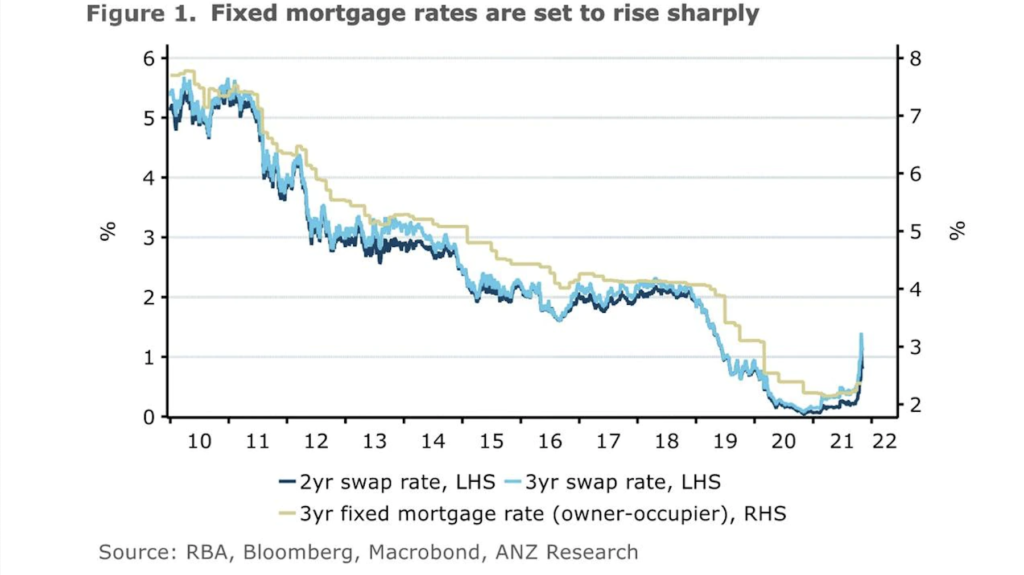

Without getting too technical, the RBA offered discounted money to Australian Banks during COVID which allowed the banks to offer lower than normal interest rates. We are now seeing interest rates beginning to return to pre-Covid levels. The variable cash rate has increased to 0.85% but it is still well below the historical cash rate. Fixed interest rates however, have dramatically increased behind the scenes with little warning and have already increased to above pre-covid levels.

Why do fixed interest rates change so dramatically?

Fixed interest rates generally reflect future thoughts on interest rate movements by money markets and the banks. Fixed rates, eg. 3 to 5 years, are simply reflecting where the banks and money markets think interest rates may be in 3 to 5 years time. Fixed rate funding costs are reflected in SWAP markets. It is very different from tracking the official cash rate set by the RBA. Long term, the official cash rate and fixed rate SWAP markets will follow similar trends but short term they can differ quite noticeably. SWAP is a term used in finance and banking markets to trade money. When banks trade money in these SWAP markets, they try to ensure they do not lose money.

In summary, variable interest rates are normally indicative of current RBA monetary policy whereas fixed interest rates are an indication of where banks and financial markets think they may move over that fixed interest rate period. Consequently, it is a gamble to a point as market conditions can change during a fixed interest rate period. If inflation and housing demand continue to grow then interest rates may continue to rise as predicted by the fixed rate markets. Alternatively, if inflation stagnates and property markets cool, variable rates may not reach the heights of the current fixed interest rates on offer.

Another unknown is the potential from future pandemic or global recessionary concerns. If the global markets stagger, then it is theoretically possible for the official cash rate to remain flat or even decrease again. Looking to the RBA cash rate graph, we can also see the impact that the GFC had on interest rates back in 2009/2010. Following a sharp decline, interest rates increased and then started falling back again during 2011 to 2016.

The truth is that everyone has their theories, but nobody actually knows for sure what will happen. The current times we are in with interest rates are unprecedented, as is the global pandemic we are coming through. When looking at fixed rates versus variable rates, the best thing you can do is ask yourself whether it makes sense.

In the peak of COVID, the RBA discounted money to the banks and we saw fixed rates for 3 or 4 years around 1.99%. The variable interest rate was around 2.2 – 3% depending upon equity you had in the property. As at 13 June 2022, that same fixed rate was between 4.5% and 5.2% with many banks. The variable rate however was still around the 2.3 – 3% range even after the RBA increase in May 2022.

Should I fix my interest rate?

If the fixed rate being offered to you is say 4.5% for 3 years and the variable rate is 2.5%, there is a 2.0% difference. To break even on the 4.5% fixed rate, the RBA would have to officially increase the cash rate by 0.25% 8 times. Is this possible? Yes of course it is possible. Is it likely? We just don’t know. The so-called experts are suggesting several interest rate rises in the short term, but we don’t know how high they will go or whether they will stagnate or drop again. You will only save money on a fixed interest rate if the variable interest average is above the fixed rate for that period.

The ongoing unknowns for interest rates from this point are, in part inflation, global stock market performance, a potential global recession, impacts of the lowest unemployment in Australia since 1974 and potential fiscal changes from the recent incoming Australian Labor Party (ALP) Government. These changes will include wage growth which tends to have an underlying increase on inflation.

What are the impacts on your repayments if you fix your interest rate?

On a $600,000 home loan, if you were to fix for 3 years at 4.5%, your repayments would be approximately $3,040/month over a 30 year loan term. The same loan on a variable interest rate at 2.5% would have a repayment of $2,371/month. The difference is $669/month. At a 3.5% variable interest rate, your monthly repayment would be $2,695/month which is still $345 less than the fixed rate option at 4.5%. In these scenarios, you may be better off remaining on a variable rate but paying that extra amount into your home loan, thereby reducing your interest and getting ahead on your loan.

Alternatively, if the variable interest rate was 5.5%, your repayment would increase to $3,407/month which is $367/month more than the 4.5% fixed rate. So the question you need to ask yourself is whether you think the variable interest rate average over the fixed rate term will be higher or lower than the fixed rate.

As mortgage brokers we cannot tell you what do to with fixed or variable interest rates, because the reality is that no one knows for certain what will happen. What we can do is help you prepare for rate increases and provide detailed loan comparisons to assist you with the decision-making process.

Leave a Comment